Tesla Just Lost the EV Crown (And Nobody Saw It Coming)

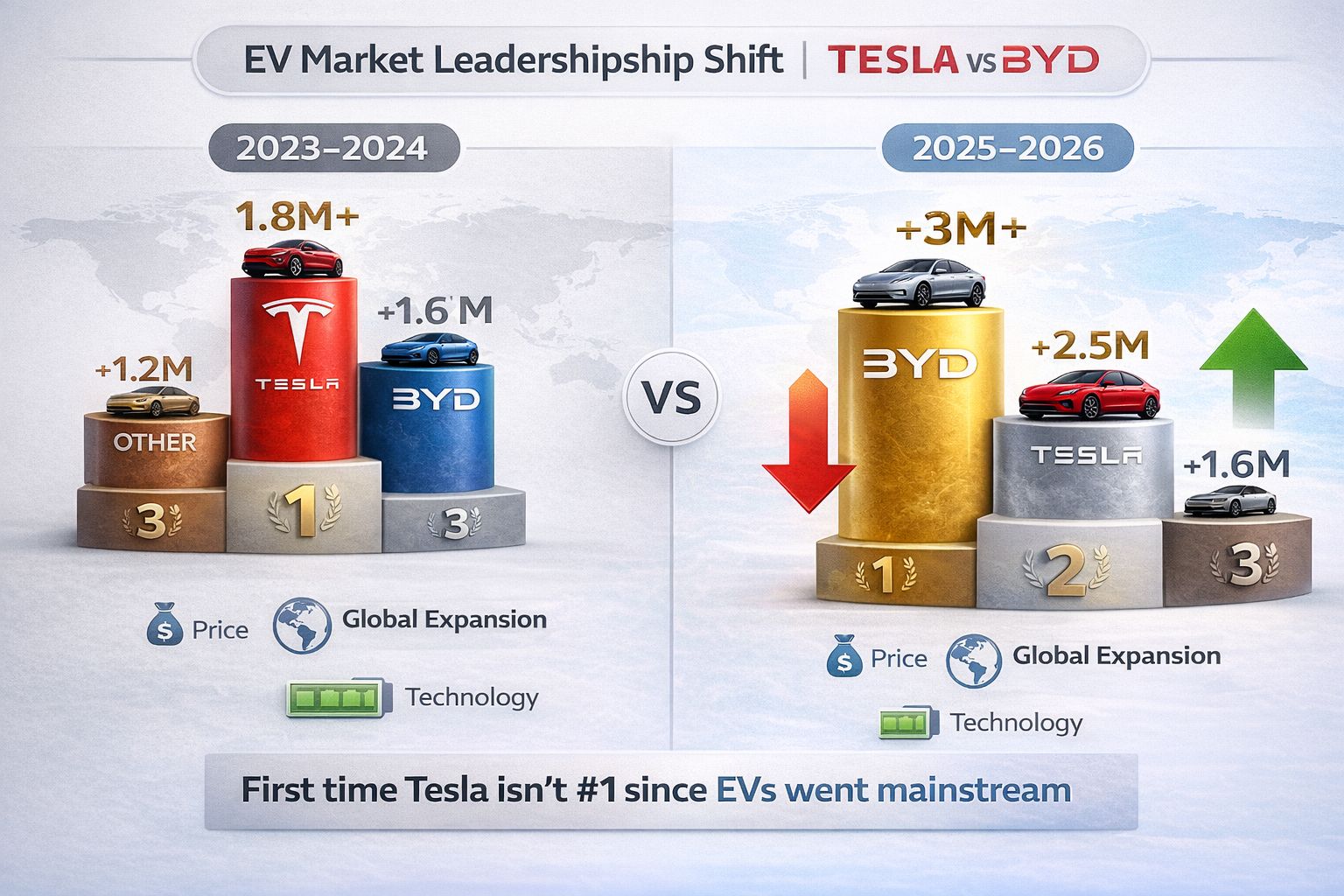

For the first time in EV history, Tesla is no longer the world's top electric vehicle seller. BYD, the Chinese automaker, has officially taken the crown.

If you asked ChatGPT two years ago "Who will lead the EV market in 2026?", it would've said Tesla.

If you asked it today about what actually happened, it would be learning from a major prediction failure.

Because this week, BYD officially became the world's largest EV maker and it's a perfect case study in why AI models (and humans) struggle to predict disruption.

Here's what happened...

For the first time since electric vehicles became mainstream, Tesla is not the world's top seller.

BYD, the Chinese automaker most people have never heard of, just officially overtook Tesla as the global leader in electric vehicle sales.

This is huge. Tesla has owned the EV market for years. They were the company that made electric cars cool. The brand everyone thought of when someone said "electric vehicle." The stock that made early investors millionaires.

And now they're not number one anymore.

How Did This Happen?

BYD didn't come out of nowhere. They've been climbing for years, but 2025 was the tipping point.

Here's what changed:

China dominates global EV sales. And BYD is a Chinese company selling primarily to Chinese buyers. China is the largest car market in the world, and EVs make up a massive chunk of new car sales there. BYD has home advantage.

BYD sells cheaper cars. While Tesla focuses on premium vehicles (Model 3 starts around $40K in the US), BYD makes affordable EVs that regular people can actually buy. In markets like Southeast Asia, South America, and even Europe, price matters more than brand prestige.

Tesla's US advantages disappeared. Remember the $7,500 federal tax credit for EVs? That expired for many Tesla models. Suddenly, Teslas got more expensive for American buyers while competitors kept credits. That hurt sales.

BYD expanded globally. They're not just selling in China anymore. BYD is moving into Europe, Australia, Southeast Asia, and South America aggressively. They're building factories, opening dealerships, and competing directly with Tesla in markets Tesla used to dominate.

Tesla had a rough 2025. Controversial Cybertruck launch. Production delays. Elon Musk's attention split between Tesla, X (formerly Twitter), SpaceX, and his new AI company xAI. Tesla didn't launch a major new model in 2025 while competitors flooded the market with options.

Tesla focused on premium EVs in Western markets while BYD captured global sales with affordable electric vehicles and plug-in hybrids, particularly dominating the massive Chinese market.

📺 Article continues after this brief message from our sponsor...

💼 Today's Sponsor: Gladly

Tesla lost customers. Don't let your support team make the same mistake.

Gladly Customer AI delivers radically personal service at scale. One lifelong conversation per customer across every channel. AI handles routine questions. Your team handles the rest.

Your competitors are already automating. Here's the data.

Retail and ecommerce teams using AI for customer service are resolving 40-60% more tickets without more staff, cutting cost-per-ticket by 30%+, and handling seasonal spikes 3x faster.

But here's what separates winners from everyone else: they started with the data, not the hype.

Gladly handles the predictable volume, FAQs, routing, returns, order status, while your team focuses on customers who need a human touch. The result? Better experiences. Lower costs. Real competitive advantage. Ready to see what's possible for your business?

⬇️ Back to the EV battle...

What BYD Actually Is

Most people have no idea what BYD is. Let's fix that.

BYD stands for "Build Your Dreams." They started in 1995 making batteries. Then they moved into cars. Now they're the world's largest EV manufacturer.

They make everything from compact sedans to buses to trucks. Their EVs are popular because they're cheap, reliable, and have solid range. No, they don't have Tesla's sexy brand image or Autopilot hype. But they work, they're affordable, and people are buying them.

BYD also makes plug-in hybrids, not just pure electric vehicles. That gives them more flexibility in markets where charging infrastructure isn't great yet.

Warren Buffett invested in BYD back in 2008. He saw this coming before most people even knew Tesla existed.

The shift happened gradually through 2025 as BYD's affordable pricing strategy, global expansion, and dominance in China overcame Tesla's premium brand positioning and US tax credit losses.

Does This Actually Matter?

Yes. Here's why.

It breaks Tesla's invincibility myth. For years, Tesla felt unstoppable. The stock kept climbing. Elon kept promising the future. Investors believed Tesla would own the entire EV market forever. Now that narrative is cracked.

It shows China's automotive power. Western automakers used to dominate globally. Now a Chinese company is beating the most hyped American car company at its own game. This isn't just about EVs. It's about where global manufacturing power is shifting.

Tesla's stock could take a hit. Investors hate losing market share. If Tesla isn't the undisputed EV king anymore, does it deserve its massive valuation? Expect analysts to start asking that loudly in 2026.

Competition is finally real. For years, traditional automakers were slow to compete with Tesla. Now BYD, plus Chinese rivals like NIO and Xpeng, plus European brands like Volkswagen and BMW, are all fighting for EV market share. Tesla can't coast anymore.

BYD's victory comes largely from dominating China, the world's largest EV market, while expanding aggressively into Europe, Southeast Asia, and South America where price-conscious buyers prefer affordable options over Tesla's premium positioning.

What Happens Next

Tesla isn't going away. They're still huge in the US. They still have brand loyalty. They still have Supercharger infrastructure. And they're still profitable, which many EV companies are not.

But this is a wake-up call.

Elon Musk will probably tweet something dismissive about how BYD's numbers include hybrids and Tesla only counts pure EVs. Technically true, but it won't change the headline: BYD sold more cars.

Tesla needs new models. The Cybertruck is polarizing. The Model 3 and Y are aging. The Roadster and Semi have been "coming soon" for years. Tesla promised a $25K budget EV and still hasn't delivered it.

Meanwhile, BYD is launching new models constantly. Building factories everywhere. Pricing aggressively.

The EV market isn't a Tesla monopoly anymore. It's a real, competitive industry. And right now, a Chinese company you've probably never driven is winning.

"Charlie twice pounded the table and said, 'Buy BYD.' He was right — big time."

— Warren Buffett at Berkshire Hathaway's 2024 annual meeting

Did you see this coming? Or are you surprised BYD beat Tesla? Hit reply and let me know.

Want daily insights on tech shifts, industry surprises, and what actually matters? Subscribe to Better Every Day for analysis you can use.